will child tax credit monthly payments continue in 2022

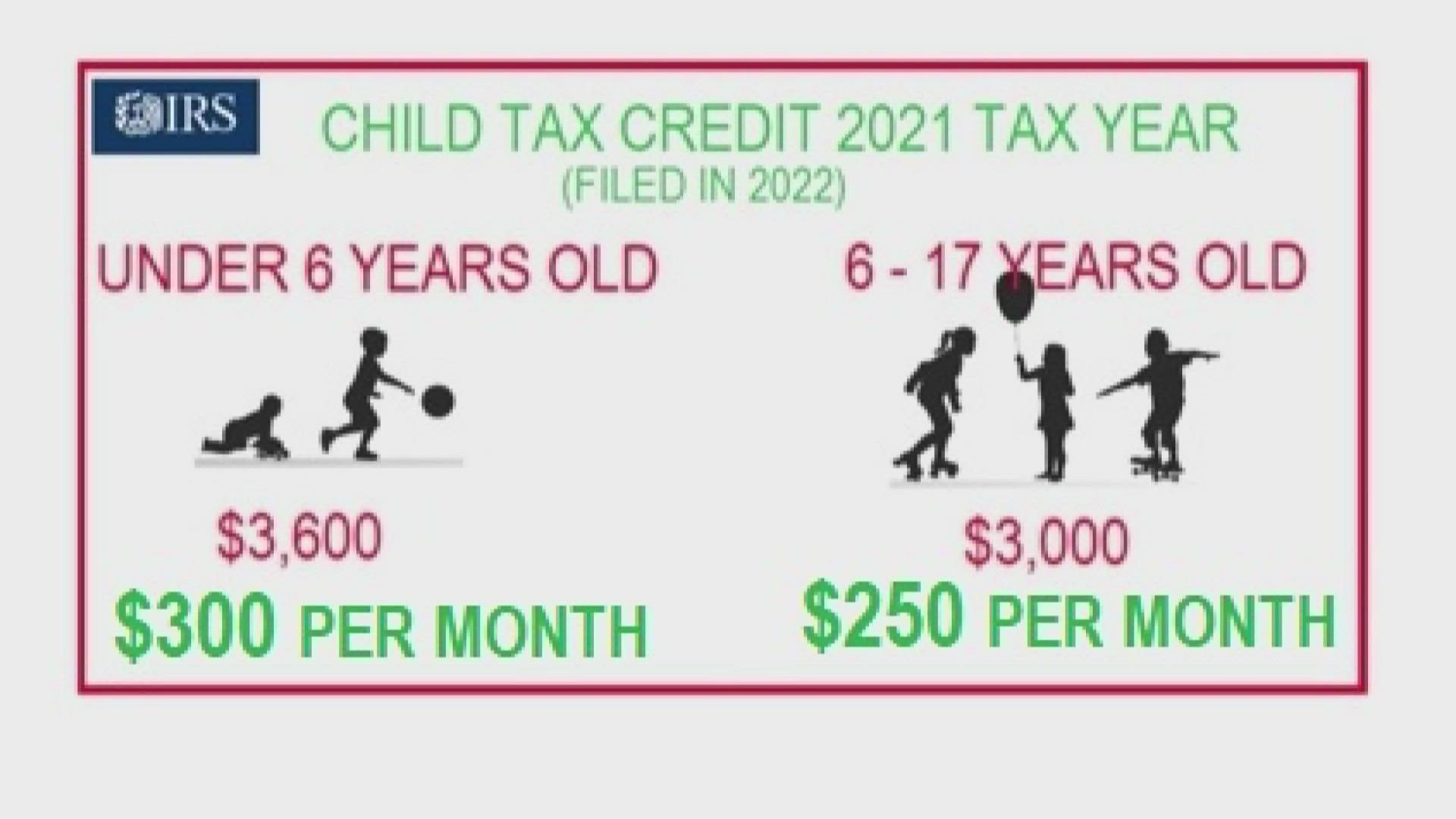

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

The Canada Child Benefit payment dates for 2022 are as listed.

. Monthly Maximum Income Guidelines Effective April 1 2022 Letters correspond to the rating codes in CBMS Co-payments may apply No enrollment fee or co-pays for American Indians. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. To receive 2022 child tax credit payments families must wait until next years tax season.

Those returns would have information like income filing status and how many children are. Those returns would have information like income filing status and how many children are. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

Canada Child Benefit Payment Dates 2022. In private adoptions the adoptive parents resident state handles everything not the state where the child was born or the. Child Tax Credit Payment Schedule 2022 from pincaliforniacompanyinfo The payments will be paid via direct deposit.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Payments are made monthly to the adoptive parents. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

We created this state tax rebate to give connecticut. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Jul 27 2022 - Illinois will issue extra food stamp benefits in August 2022Learn when these added benefits will be uploaded to your EBT card in AugustYou can find Pennsylvanias August and.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. A payment of tax credits for the tax year 2022 to 2023.

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

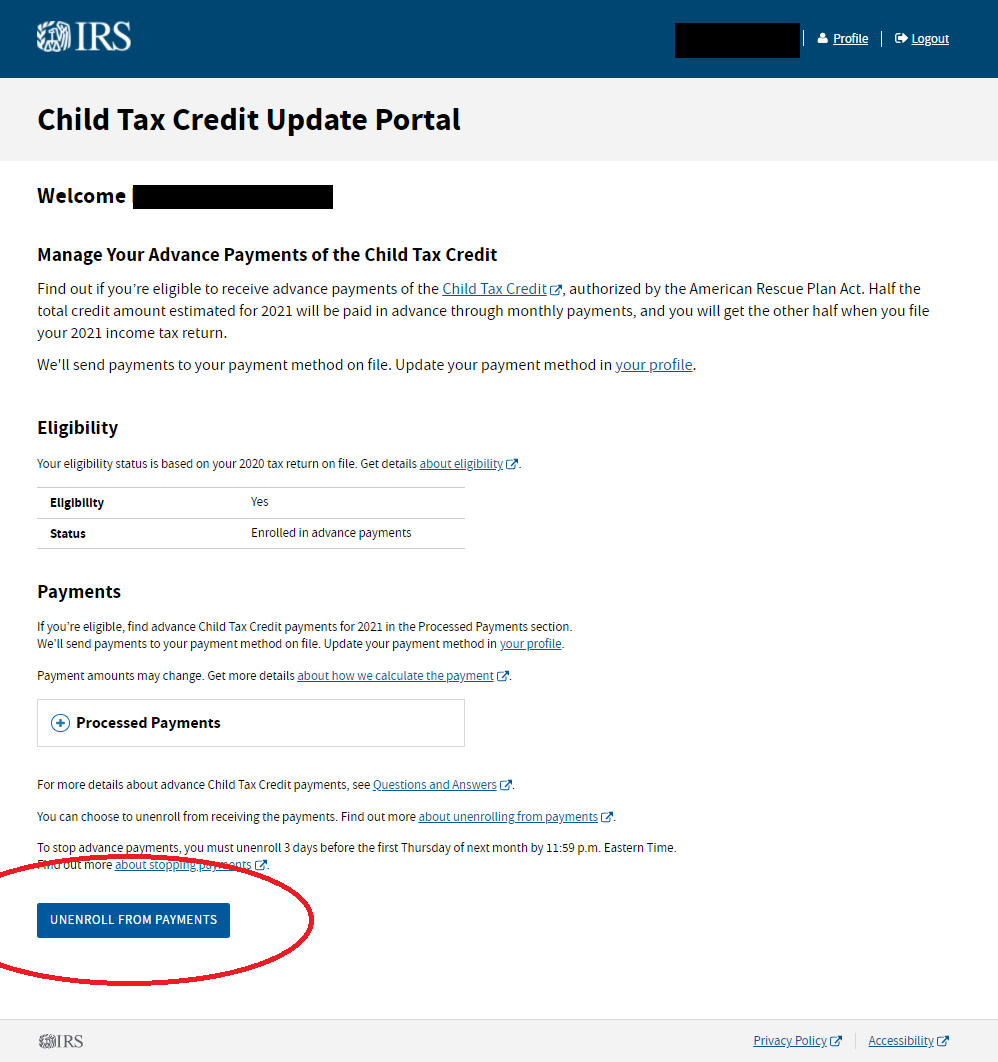

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Future Child Tax Credit Payments Could Come With Work Requirements

The New Child Tax Credit Does More Than Just Cut Poverty

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Irs Wants Millions To Claim Child Tax Credit Stimulus Funds Wjtv

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

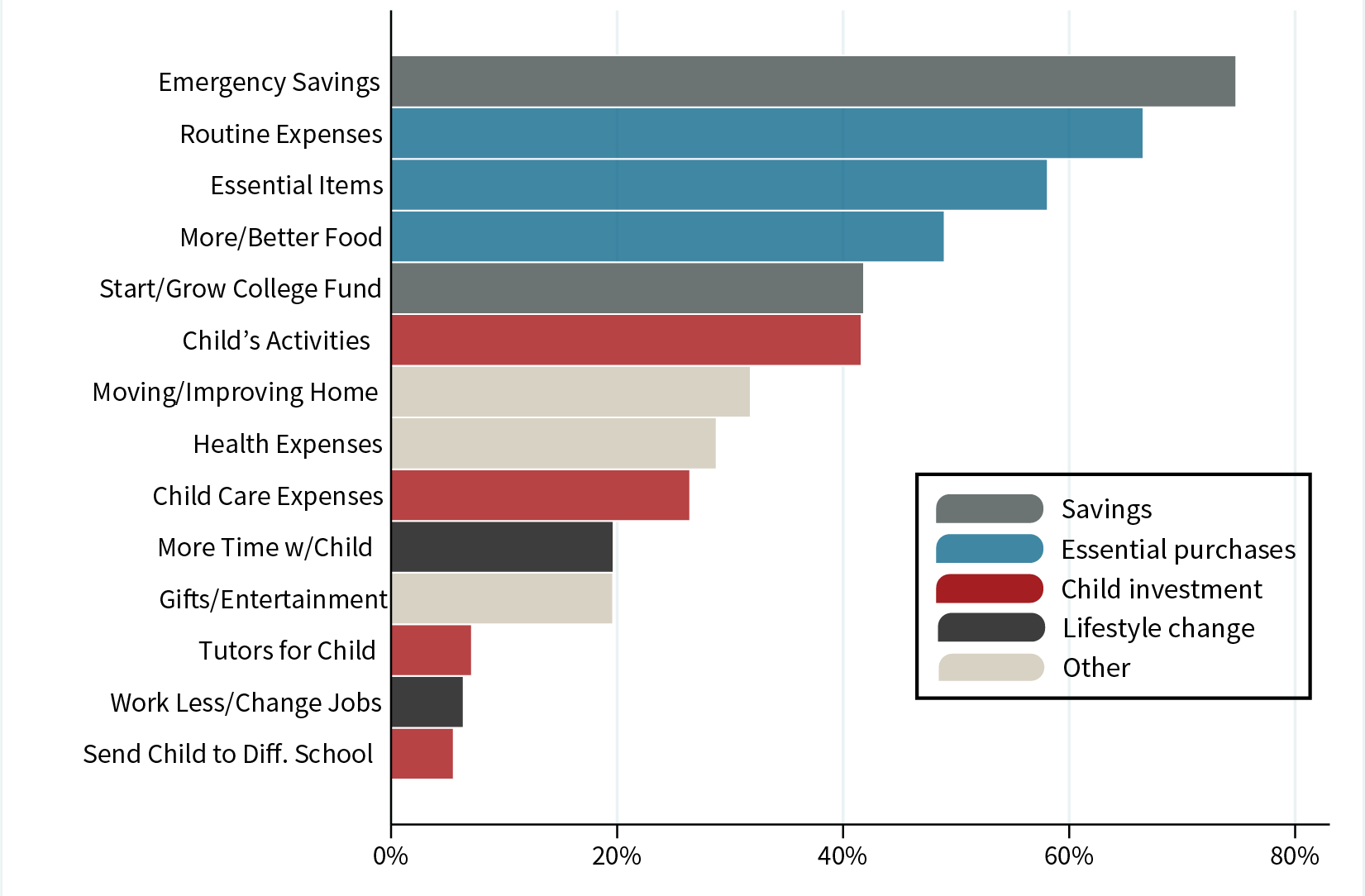

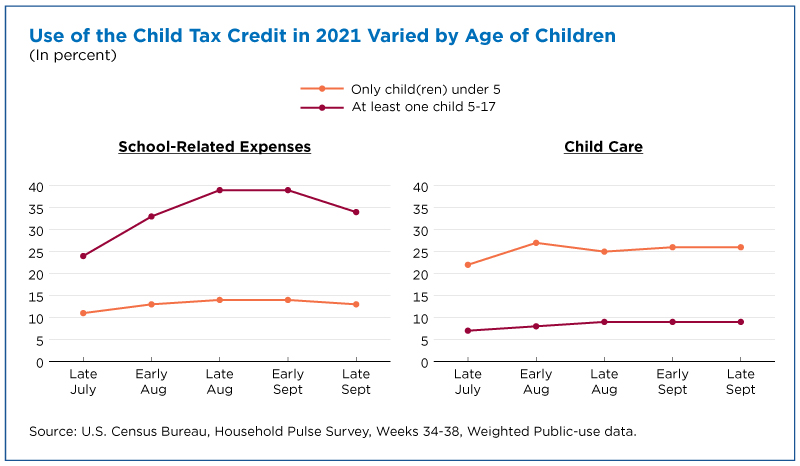

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses