irs tax levy phone number

Be prepared to discuss your financial situation with the IRS and explain why you. If you do not find the number you need below we encourage you to visit the Let Us Help You page on the IRS.

Irs Letter 2050 Overdue Taxes Or Tax Returns

It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources. Each time your federal payment is levied BFS will send you a letter of explanation including information on which federal payment was levied and advise you to contact us for resolution. The IRS can place a levy on your bank account to collect on your debt allowing it to take your funds.

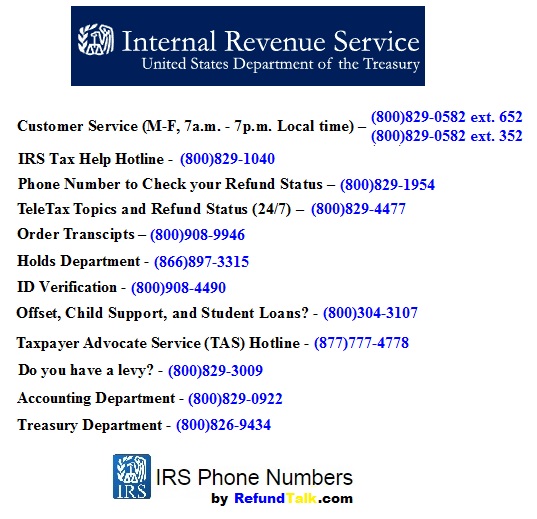

However there are many other numbers for specific questions and concerns. Call 1-800-829-1040 and be prepared to discuss an alternative way to pay your taxes. The phone number 800 829 7650.

One of the questions I get asked a lot from clients when considering a federal tax debt is whether to institute an automatic stay. Customer service phone numbers. If the IRS places a tax levy on your bank you have 21 days.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. 800 829 7650. This guide explains how to contact the IRS what you need.

We can be reached at 713 909-4906 or you can schedule an appointment with our. An IRS levy permits the legal seizure of your property to satisfy a tax debt. The first is to file IRS Form 12153 which is the Request for Collection Due Process or Equivalent Hearing.

Once that is done find the IRS phone number on your IRS levy notice or call 800-829-1040. To appeal there are two main methods. 4 pm Monday through Friday.

During peak tax season please be patient as wait time can be fairly long. The IRSs main phone number is 800-829-1040. Contact Center hours are 9 am.

Contact the LifeBack Tax team of professionals to release your IRS bank levy and get you relief from the IRS tax levies. Please contact the TAS media relations office at 202 317-6802. The IRS can also release a levy if it determines that the levy is causing.

IRS Levies on Bank Accounts. Taxpayers are not entitled to a pre-levy hearing. 617 887-6367 or 800 392-6089 toll-free in Massachusetts 617 887-6367 or 800 392.

Please note that this office is established solely for responding to inquiries from the press news media. How to Appeal a Tax Levy. TTYTDD for the hearing impaired.

Tax Exempt Bonds. If you need help with an IRS levy or have questions about IRS levies or need a levy release please contact us. Federal employer identification number FEIN.

If you are calling to check the status of your. It is different from a lien while a lien makes a claim to your assets as. The period the IRS can collect the tax ended before the levy was issued.

Call today at 855 605-1500. Contact the IRS immediately to resolve your tax liability and request a levy release.

How To Stop An Irs Wage Garnishment Or Levy My Tax Settlement

Stressed About An Irs Tax Levy Our Experts Can Handle It

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Irs Collections How To Avoid A Tax Lien Or Tax Levy Landmark Tax Group

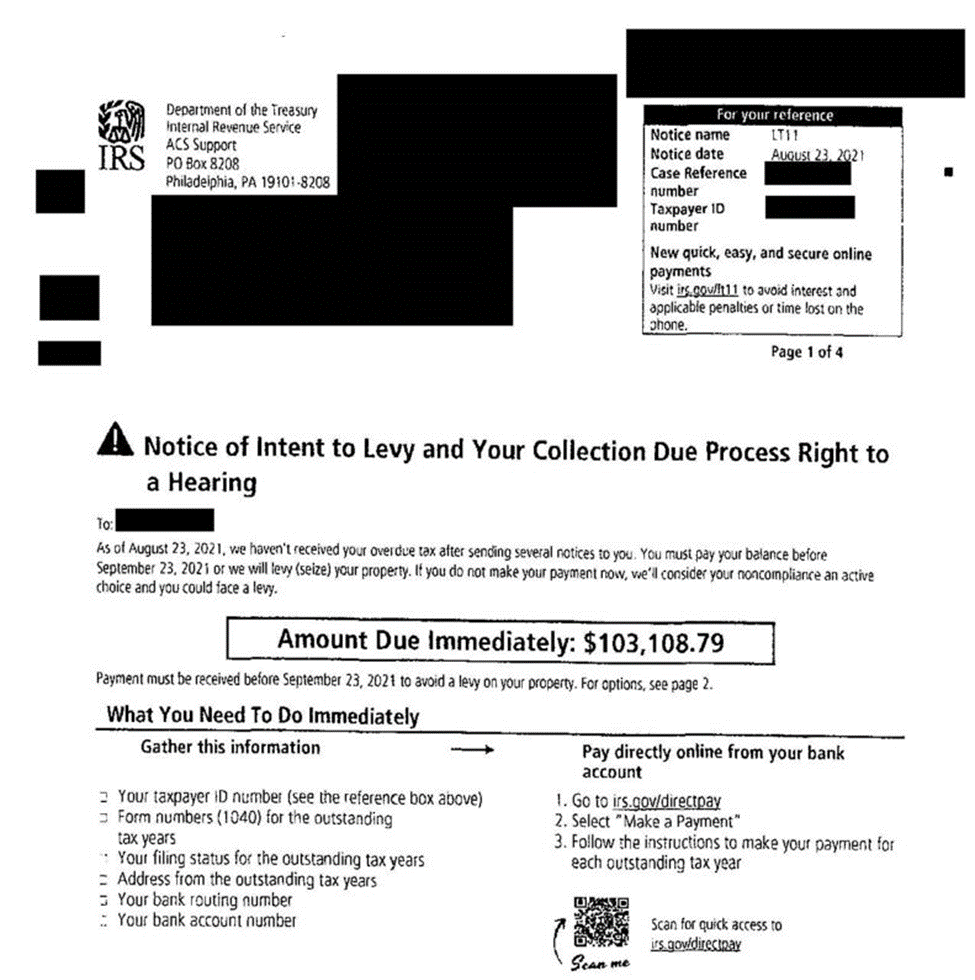

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

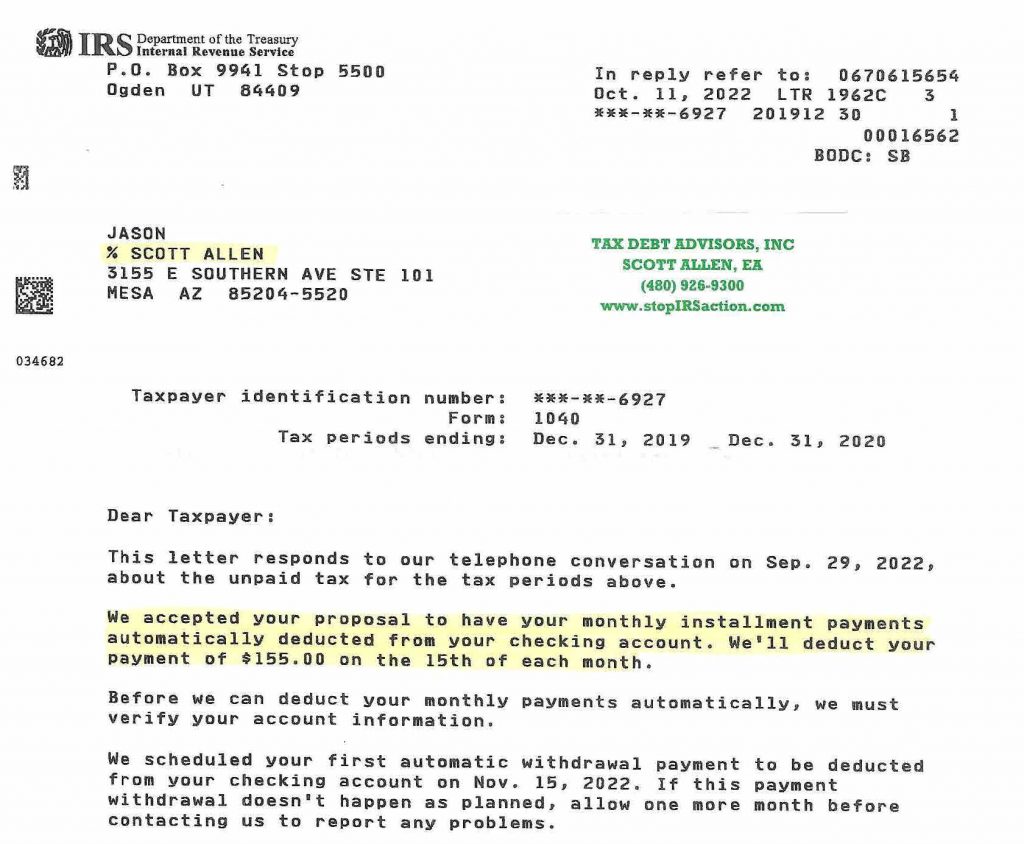

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Irs Tax Letters Explained Landmark Tax Group

What You Need To Know About Irs Levies Damiens Law Firm

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Taxrelief Tecs Did You Receive A Notice Of Intent To Levy Know Your Rights Let The Tec S Help You Handle Your Irs And Or State Tax Debt Call Us Now For A

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

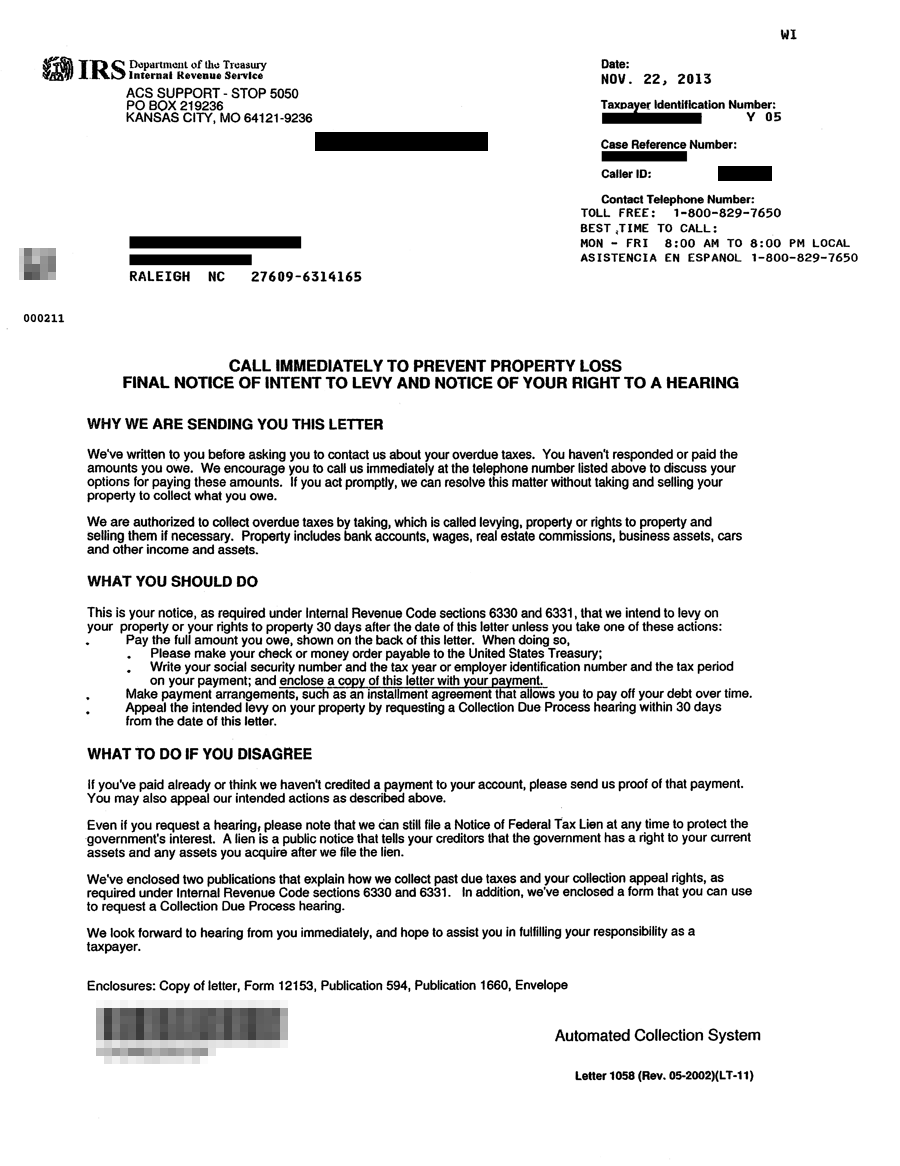

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

The Tax Relief Blog Testimonials Precision Tax Relief

Irs Bank Levies Can Take Your Money Debt Com

Irs Levy Fears Can Be Overstated Washington Tax Services